Your Patient Privacy Rights in Finances

Explore Your Patient Privacy Rights in Context

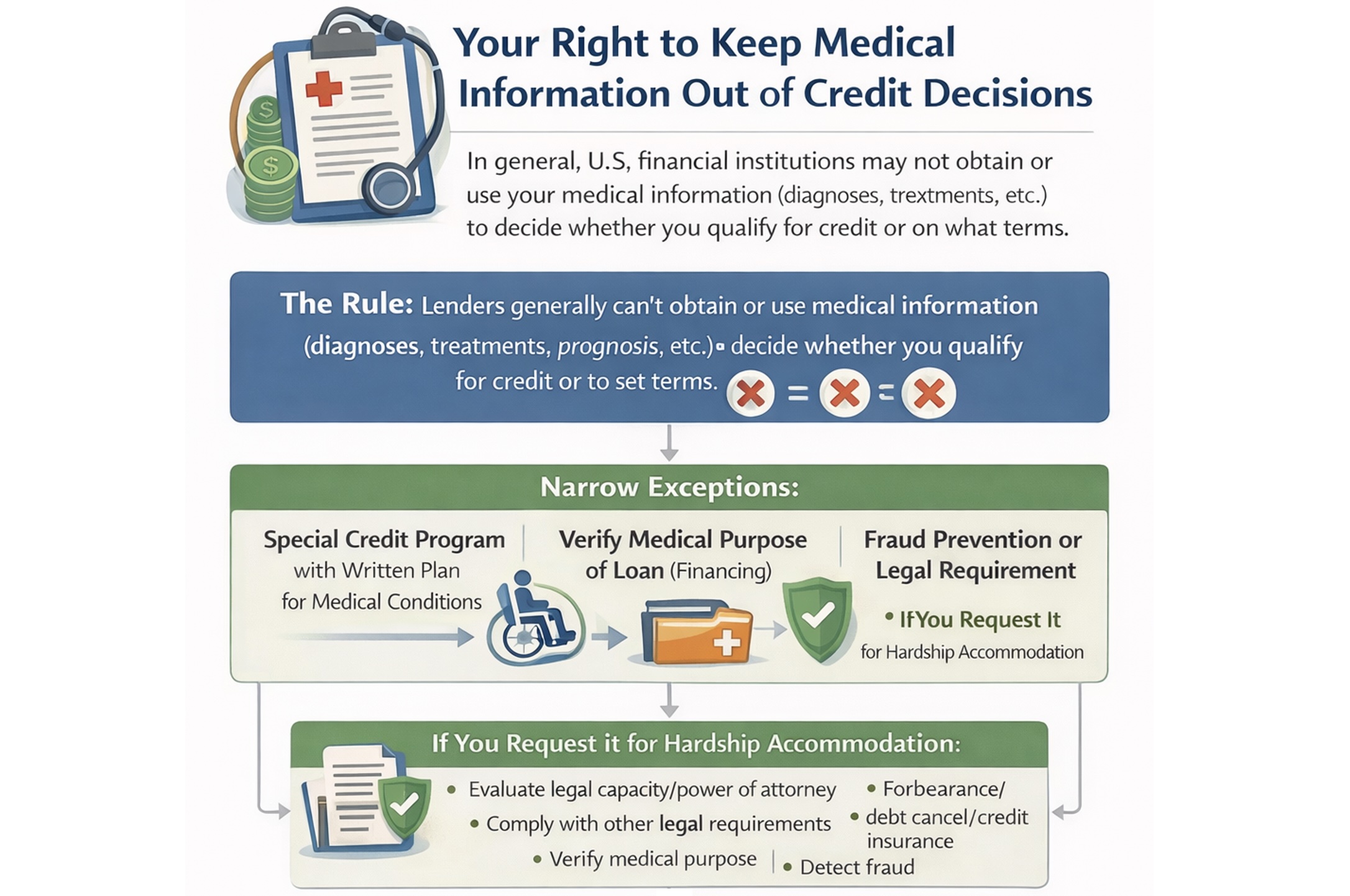

Medical information can feel intensely personal—and people often worry it could be used to judge their financial reliability. U.S. law generally tries to keep your diagnoses, treatments, and prognosis out of lending decisions, while still allowing limited use of medical information in a few specific situations (like verifying medical-purpose financing or honoring a hardship accommodation you request). The sections below explain what lenders usually cannot do, the narrow exceptions, and practical steps you can take if medical information shows up in a credit decision.

Your right to keep medical information out of credit determinations

In general, U.S. financial institutions may not obtain or use your medical information (diagnoses, treatments, prognosis, etc.) to decide whether you qualify for credit or on what terms. Regulation V (the Fair Credit Reporting Act) sets a general prohibition on creditors obtaining or using "medical information" in connection with credit eligibility decisions. There are exceptions.

Financial institutions may obtain and use medical information for certain limited purposes—e.g., a special credit program for people with medical conditions, verifying the medical purpose of a loan (medical financing), fraud prevention, or if you specifically request the creditor to consider medical circumstances as an accommodation.

Medical debt (not your medical record) can still affect credit decisions if it appears on credit reports. Financial institutions can consider medical debts as debts or expenses (financial information) as long as they treat them no worse than comparable non-medical debts and do not take your condition or prognosis into account. The major credit bureaus removed paid medical collections, increased the waiting period to one year, and removed medical collections under $500 (as of April 11, 2023).

If a creditor or financial institution receives medical information without specifically requesting it ("unsolicited"), it may use the unsolicited medical information to:

- Evaluate legal capacity or power of attorney issues triggered by a medical condition (e.g., someone acting for the consumer).

- Comply with other laws (local, state, and federal requirements).

- Determine eligibility (at the consumer's request) for a special credit program designed for people with medical conditions, under a written plan.

- Prevent or detect fraud.

- Verify the medical purpose of a loan (e.g., financing medical products/services).

- Consider medical info only if the consumer specifically asks the creditor to use it as an accommodation, and the request is documented.

- Apply a forbearance program triggered by a medical event/condition.

- Administer debt cancellation or suspension or credit insurance benefits triggered by a medical event/condition.

In the absence of an exception above, if a lender gets your diagnosis or medical details from a stray document, an email, or a note and no exception applies, they generally should not use it to decide whether you qualify for credit or on what terms.

What to do::

- Consider not volunteering diagnosis details to lenders. If a form asks for "medical reasons," keep it high-level (e.g., "medical hardship") unless you're using a program where medical eligibility is required.

- If you request an accommodation, consider limiting what you disclose. If you're asking the lender to consider medical circumstances (one of the exceptions), provide only what's necessary (dates, impact on income, documentation of hardship), not full records.

- Ask the lender what information they used. Request an explanation of adverse action (denial or worse terms) and ask whether any medical information was considered.

- Get and review your credit reports. Look for medical collections or errors that may be driving the decision; dispute inaccuracies with the credit bureau(s) and the furnisher.

- Consider disputing improper use of medical information. If you believe a lender used diagnosis, treatment, or prognosis information to decide eligibility or terms, you might consider filing a written complaint with the lender and keep records (emails, letters, screenshots).

- Escalate, if appropriate. File a complaint with the Consumer Financial Protection Bureau (covers most consumer financial products). You can also complain to the lender's prudential regulator (e.g., OCC, Federal Reserve, FDIC) depending on the institution.

- If the lender received medical information you didn't intend to provide (e.g., you uploaded the wrong document), notify them in writing and ask them to confirm it will not be used and will be deleted or segregated.

- Consider legal help for serious harm. If denial caused significant damage (housing loss, etc.), contact a consumer law clinic or attorney experienced in Fair Credit Reporting Act (Regulation V) issues.

If you have an incident to report, please let us know.

Your rights if your creditor acts on your medical condition

If you are diagnosed with a terminal illness or severe illness, a financial institution cannot usually terminate or "call in" your auto loan, small business loan, personal loan, or mortguage, or cancel your credit card.

Most loans can only be "called in" (accelerated) after a contract-defined default (missed payments, bankruptcy or insolvency triggers, breach of covenants, fraud or misrepresentation, failure to maintain required insurance/collateral, etc.). A borrower's medical condition is not typically a default event unless the contract somehow states otherwise to tie it in.

If the contract has an "insecurity" or "deems itself insecure" clause, the lender may have the power to accelerate only if it has a good-faith belief that the prospect of payment or performance is impaired. A diagnosis by itself doesn't automatically prove payment will be impaired—so a lender relying only on "terminal illness" could be on shaky ground, especially if you're current and have stable repayment sources.

Using medical information to change credit terms is generally restricted. Regulation V (Fair Credit Reporting Act) generally prohibits creditors from obtaining or using medical information in connection with a determination of a consumer's eligibility or continued eligibility for credit, with limited exceptions (e.g., you asked them to consider medical circumstances as an accommodation, medical-purpose financing verification, fraud prevention, etc.). Other narroe exceptions include: your legal capacity or the use of a power of attorney; legal requirement to comply with applicable local, state, or federal demands; you requested special credit assistance; necessary to detect or prevent fraud; you requested special accommodations for your medical condition or changed circumstances; to determine whether a forebearance program is triggered by your change in medical condition; or, to determine your eligibility for debt cancellation or suspension.

What to do: If you suspect your loan, mortguage, or credit card is being accelerated because of a recent change in your medical condition, consider the following:

- Consider asking for the specific contractual basis for acceleration (e.g., the clause and the alleged default). Seek written responses.

- Consider asking whether medical information was considered, and if so, under what legal exception.

- Consider filing a complaint with the Consumer Financial Protection Bureau if the lender is using health information improperly (and consider the bank's primary regulator as well).

- If it's a mortgage, note that additional fair-lending protections may apply (disability protections can be relevant in housing-related credit). See separate patient privacy rights item below.

Your rights if a lender tries to call your mortgage based on illness

A lender can't "call in" or accelerate your mortguage just because it learns you have a terminal or serious medical condition unless the mortgage contract gives it a specific right to accelerate and the conditions for that right are actually met.

Most mortgages can only be accelerated after a contract-defined default, like missed payments, failure to pay taxes or insurance, unauthorized transfer of the property, or other covenant breaches (acceleration clauses are commonly tied to default events).

Regulation V (Federal Credit Reporting Act) generally restricts a creditor from obtaining or using medical information in decisions about your eligibility or continued eligibility for credit, with only narrow exceptions. These narrow exceptions for a creditor to obtain or use your medical information to decide your continued elgibility for credit include: your legal capacity or the use of a power of attorney; legal requirement to comply with applicable local, state, or federal demands; you requested special credit assistance; necessary to detect or prevent fraud; you requested special accommodations for your medical condition or changed circumstances; to determine whether a forebearance program is triggered by your change in medical condition; or, to determine your eligibility for debt cancellation or suspension.

Calling a mortguage is effectively a "continued eligibility terms" action—so relying on your diagnosis as the reason is risky for the lender unless an exception applies.

On the other hand, some mortguage contracts include "insecurity" or "deems itself insecure" language. Under the Uniform Commercial Code, such a clause generally allows acceleration only if the lender in good faith believes the prospect of payment is impaired. That said, this is not the typical way consumer mortgages are accelerated (most are accelerated for specific defaults). And medical condition alone does not automatically show nonpayment—especially if you're current.

If the lender's action is tied to disability/health status rather than actual default, it may also raise fair lending concerns. The Federal Trade Commissions' consumer guidance notes that the Equal Credit Opportunity Act and the Fair Housing Act protect people from discrimination in mortgage lending.

What to do: If you're worried this is happening:

- Consider asking for the exact basis in your mortgage documents (note/deed of trust): "What clause are you invoking, and what default are you alleging?"

- Consider asking whether medical information was a factor in their decision, and if so, which Regulation V exception they believe applies.

- Document everything (letters, call notes, screenshots).

- Consider filing a complaint with the Consumer Financial Protection Bureau and, if discrimination seems involved, consider a fair lending complaint path (under the Equal Credit Opportunity Act or Fair Housing Authority).

Taken together, these protections are meant to keep health details from becoming a backdoor way to deny credit or worsen terms—while still allowing narrow, documented uses when you ask for help or the loan itself is medical in purpose. But gaps remain, and vigilance matters: even small disclosures can lead to serious personal financial consequences. To stay informed as rules and practices evolve and incidents occur, join our mailing list. And if you experience a concerning situation tied to your health information, please report the incident so we can track patterns and strengthen public accountability. Donate, as you are able, to support this work.

Select another context in which to examine your patient privacy rights:

Note: The content above is general information for the public and is not legal advice for any specific situation. Rights and processes relevant to a particular situation can vary based on circumstances and additional state or federal laws.

This document was created and is maintained by PPR President Dr. Latanya Sweeney. Please share your feedback and let Dr. Sweeney know about the ways you've used it, and if you have any suggestions.