Your Patient Privacy Rights in Life Insurance

Explore Your Patient Privacy Rights in Context

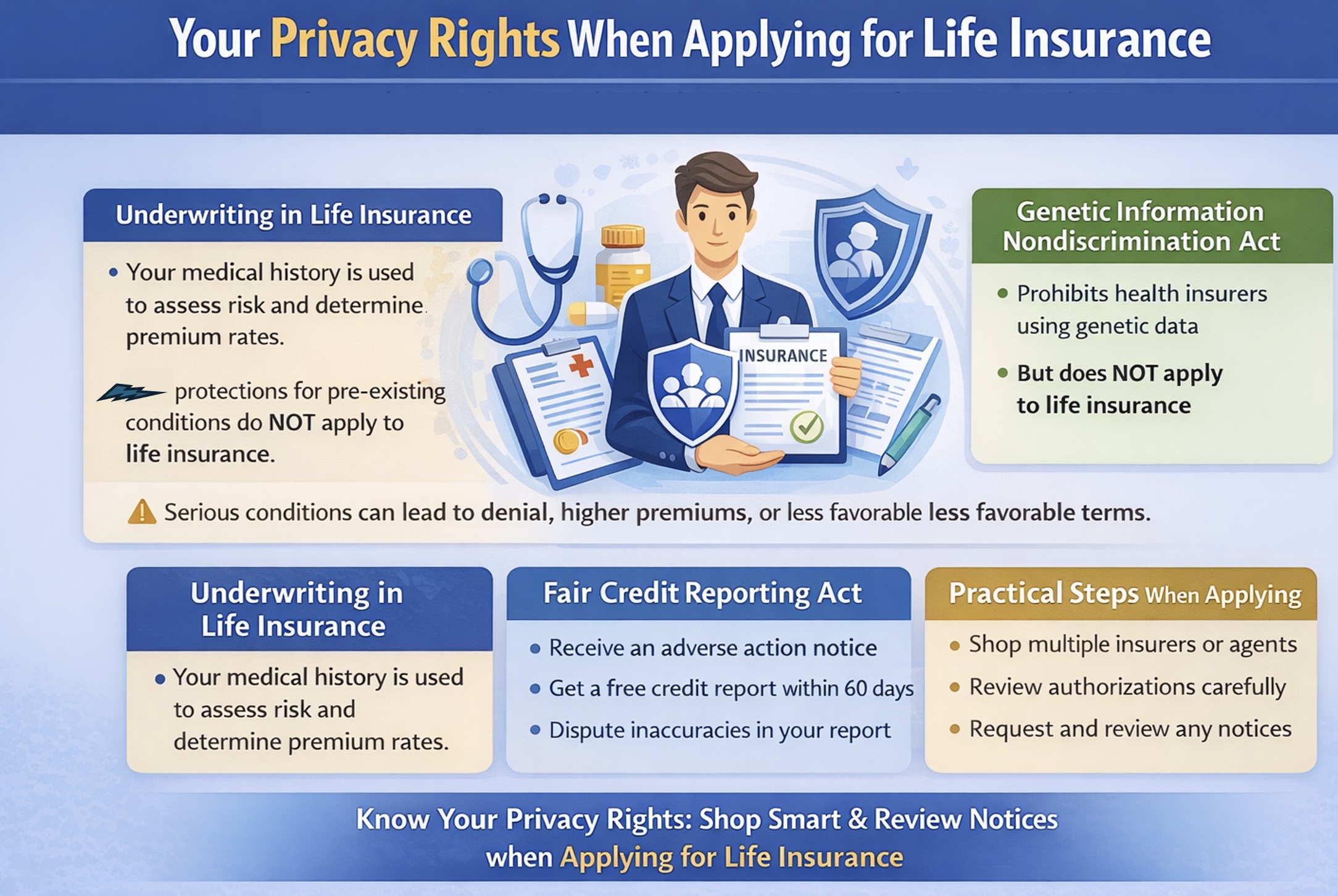

In the U.S., life insurers commonly use your medical history—including prior diagnoses and procedures—during underwriting to decide whether to offer coverage and at what price. Unlike major medical health insurance, life insurance is typically medically underwritten, and a serious condition or high-risk history can lead to a denial, a higher premium, or different policy terms.

Your Privacy Rights When Applying for Life Insurance

The Affordable Care Act protections against being denied medical insurance based on pre-exisitng condditions does not apply to life insurance.

The Genetic Information Nondiscrimination Act that generally prohibits health insurers from using your genetic information (including family medical history and genetic test results) to determine eligibility, set premiums, or impose coverage restrictions; and prohibts employers from using genetic information in hiring, firing, job assignments, or promotions, and from requesting or requiring genetic information in most circumstances, does not apply to life insurance.

If a life insurer takes an adverse action against you (e.g., denies coverage, offers a higher premium, reduces coverage, or otherwise makes terms less favorable) based in whole or in part on a consumer report, you have the right under the Fair Credit Reporting Act to receive an adverse action notice. That notice must tell you, at a minimum:

- That adverse action was taken (or that less favorable terms were offered) based in part on information in a consumer credit report.

- The name, address, and phone number of the consumer reporting agency that supplied your credit report.

- A statement that the consumer reporting agency did not make the decision and cannot explain why the insurer took the action.

- Your right to get a free copy of your consumer credit report from that consumer reporting agency within 60 days.

- Your right to dispute the accuracy or completeness of information in your report with the CRA.

- If the insurer used your credit score from your consumer report in making the decision, the notice must also include credit score disclosures (the score used and related required details).

If you are worried about being declined life insurance, practical options include shopping carriers, working with an independent agent, considering products having smaller benefits or higher cost, and being careful to answer health questions accurately to avoid later rescission or claim disputes.

What to do: Before applying, shop multiple carriers (or use an independent agent), and read any medical-record authorization carefully—ask to narrow it when possible. If you're denied or offered worse terms, request and review the adverse action notice, get your free consumer report within 60 days, and dispute any inaccuracies with the reporting agency; keep copies of all correspondence and answer all application questions accurately to avoid later rescission or claim disputes. If you have an incident to report, please let us know.

Understanding how your health and financial information may be used in life insurance underwriting—and knowing your rights under federal laws like the Fair Credit Reporting Act—can help you navigate the process more confidently, protect your privacy, and respond effectively to unfair or inaccurate decisions. To stay informed as rules and practices evolve and incidents occur, join our mailing list. And if you experience a concerning situation tied to your health information, please report the incident so we can track patterns and strengthen public accountability. Donate, as you are able, to support this work.

Select another context in which to examine your patient privacy rights:

Note: The content above is general information for the public and is not legal advice for any specific situation. Rights and processes relevant to a particular situation can vary based on circumstances and additional state or federal laws.

This document was created and is maintained by PPR President Dr. Latanya Sweeney. Please share your feedback and let Dr. Sweeney know about the ways you've used it, and if you have any suggestions.