Your Patient Privacy Rights in Housing

Explore Your Patient Privacy Rights in Context

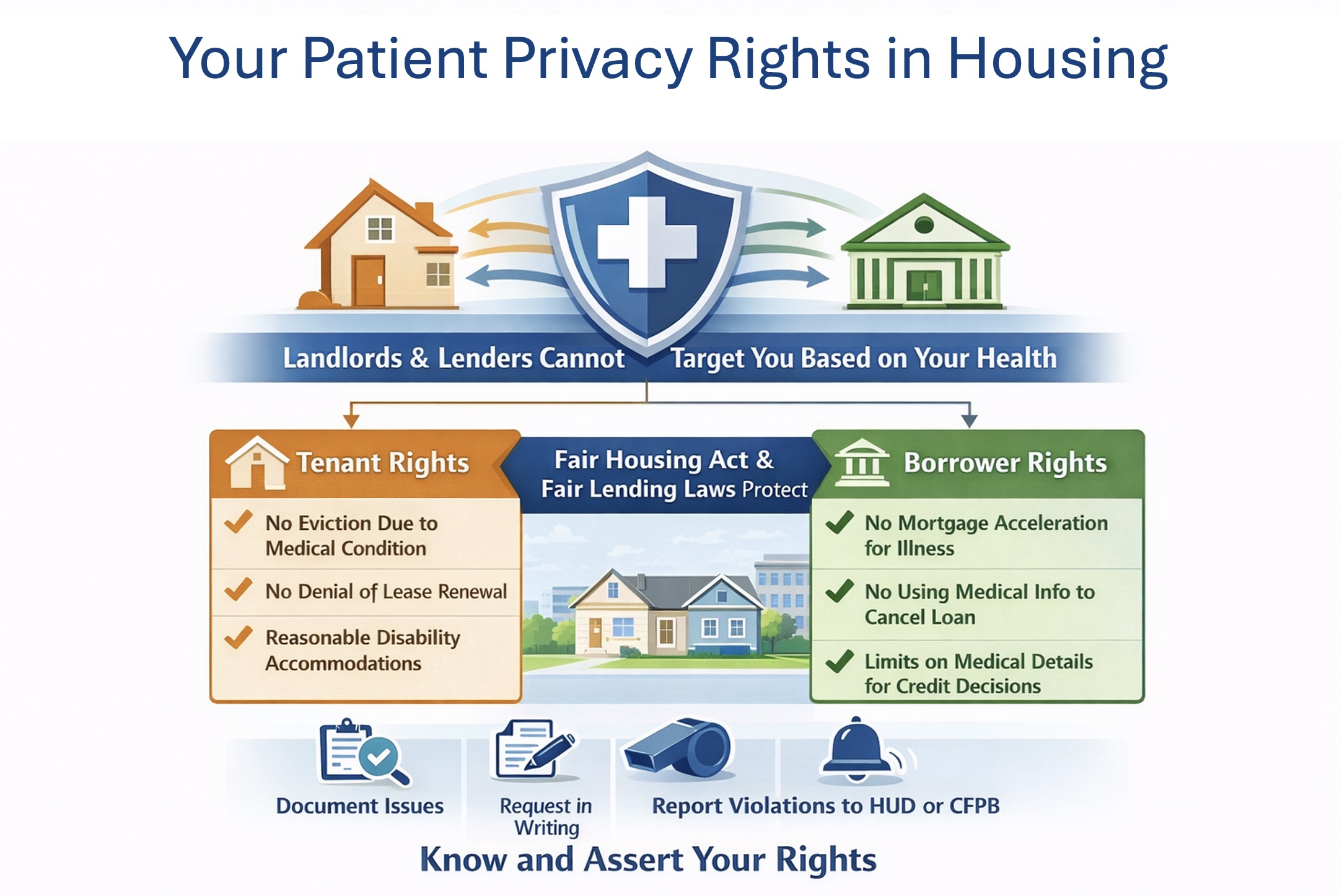

Your medical condition is not a lawful reason for a landlord or lender to single you out, terminate housing, or accelerate a mortgage—and federal law provides important protections when health and housing intersect.

Your rights if a landlord acts on your medical condition

In the U.S., a landlord can't usually terminate your lease because you're ill. In general, you cannot be denied housing or have a lease terminated because of a medical condition when that condition qualifies as a disability under federal fair housing laws. condition generally qualifies as a disability if it fits any of these categories: (a) condition generally qualifies as a disability if it fits any of these categories; (b) A record of having such an impairment (a documented history of a substantially limiting impairment); or, (c) Being regarded as having such an impairment (treated by others as if you have a substantially limiting impairment, even if you do not). The Fair Housing Act's definition of disability does not include current, illegal use of or addiction to a controlled substance.

Under the Fair Housing Act (Fair Housing Act) and U.S. Housing and Urban Development (HUD)'s implementing rules, housing providers generally may not:

- Refuse to rent or "otherwise make unavailable" housing because of disability.

- Apply different terms/conditions (including rules or policies) because of disability.

- Refuse reasonable accommodations needed for a person with a disability to use and enjoy housing.

A landlord can still enforce neutral lease rules—for example, evict for nonpayment, serious lease violations, or property damage—so long as it's not a pretext for disability discrimination. The Fair Housing Act also has a limited "direct threat" exception, but it must be based on reliable, objective evidence and an individualized assessment, not stereotypes about a diagnosis.

How much medical information can a landlord demand? If your disability (or the need for an accommodation) is not obvious, a housing provider may request limited information to verify that: (a) you have a disability (as defined by the Fair Housing Act); and (b) the requested accommodation is disability-related. But requests should be narrow—not a fishing expedition into your full medical history. (U.S. Housing and Urban Development offers guidance on what information may be requested in support of an accommodation request.)

What to do: If you suspect denial or termination based on illness, consider asking for the reason in writing (and keep all emails/texts/notices). If you need an accommodation (e.g., extra time to pay due to hospitalization, a live-in aide, parking adjustment), consider requesting it in writing. Consider filing a fair housing complaint with HUD or your state or local fair housing agency. If you have an incident to report, please let us know.

Your rights if a lender tries to call your mortgage based on illness

A lender can't "call in" or accelerate your mortguage just because it learns you have a terminal or serious medical condition unless the mortgage contract gives it a specific right to accelerate and the conditions for that right are actually met.

Most mortgages can only be accelerated after a contract-defined default, like missed payments, failure to pay taxes or insurance, unauthorized transfer of the property, or other covenant breaches (acceleration clauses are commonly tied to default events).

Regulation V (Federal Credit Reporting Act) generally restricts a creditor from obtaining or using medical information in decisions about your eligibility or continued eligibility for credit, with only narrow exceptions. These narrow exceptions for a creditor to obtain or use your medical information to decide your continued elgibility for credit include: your legal capacity or the use of a power of attorney; legal requirement to comply with applicable local, state, or federal demands; you requested special credit assistance; necessary to detect or prevent fraud; you requested special accommodations for your medical condition or changed circumstances; to determine whether a forebearance program is triggered by your change in medical condition; or, to determine your eligibility for debt cancellation or suspension.

Calling a mortguage is effectively a "continued eligibility terms" action—so relying on your diagnosis as the reason is risky for the lender unless an exception applies.

On the other hand, some mortguage contracts include "insecurity" or "deems itself insecure" language. Under the Uniform Commercial Code, such a clause generally allows acceleration only if the lender in good faith believes the prospect of payment is impaired. That said, this is not the typical way consumer mortgages are accelerated (most are accelerated for specific defaults). And medical condition alone does not automatically show nonpayment—especially if you're current.

If the lender's action is tied to disability/health status rather than actual default, it may also raise fair lending concerns. The Federal Trade Commissions (FTC)'s consumer guidance notes that the Equal Credit Opportunity Act and the Fair Housing Act protect people from discrimination in mortgage lending.

What to do: If you're worried this is happening:

- Consider asking for the exact basis in your mortgage documents (note/deed of trust): "What clause are you invoking, and what default are you alleging?"

- Consider asking whether medical information was a factor in their decision, and if so, which Regulation V exception they believe applies.

- Document everything (letters, call notes, screenshots).

- Consider filing a complaint with the Consumer Financial Protection Bureau and, if discrimination seems involved, consider a fair lending complaint path (under the Equal Credit Opportunity Act or Fair Housing Authority).

If you're dealing with a serious medical condition, it's important to know that landlords and lenders generally cannot take adverse action against you simply because of your health. To stay informed as rules and practices evolve and incidents occur, join our mailing list. And if you experience a concerning situation tied to your health information, please report the incident so we can track patterns and strengthen public accountability. Donate, as you are able, to support this work.

Select another context in which to examine your patient privacy rights:

Note: The content above is general information for the public and is not legal advice for any specific situation. Rights and processes relevant to a particular situation can vary based on circumstances and additional state or federal laws.

This document was created and is maintained by PPR President Dr. Latanya Sweeney. Please share your feedback and let Dr. Sweeney know about the ways you've used it, and if you have any suggestions.